Published on 26.05.25

In connection with the successful and largest public share offering in Icelandic history of the government’s remaining shares in Íslandsbanki there was a significant surge in activity on the Icelandic stock market, as a considerable number of retail investors entered the market for the first time.

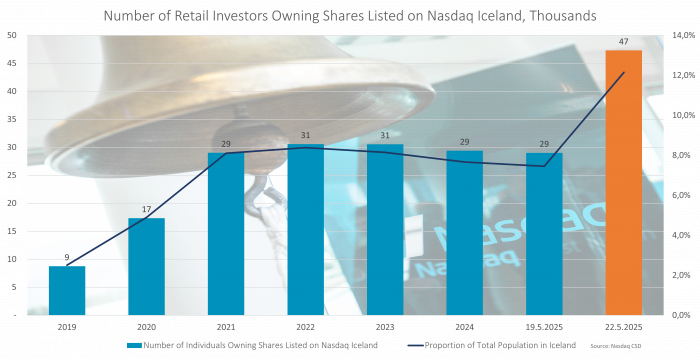

Prior to the offering, the total number of individuals holding shares in listed companies on Nasdaq Iceland* and in securities accounts with Nasdaq CSD in Iceland stood at just over 29,000.

According to data from the Nasdaq CSD, this number increased substantially following the offering, reaching over 47,300 individuals. This represents a 63% increase in the number of individuals currently holding shares.

Historically, well-executed IPOs and public offerings have proven effective in boosting retail investor participation in the stock market (see chart). The 2020 Icelandair offering was the first sign of this trend, as the number of shareholders in the company rose from 4,000 to approximately 11,000, and the total number of individuals holding shares in listed companies increased from 9,000 to 17,000. Subsequent offerings by companies such as Síldarvinnslan, the IPO of Íslandsbanki, Play, and Solid Clouds in 2021, as well as Ölgerðin, Nova, and Hampiðjan in 2022, and Ísfélagið in 2024, also contributed to the growth in retail investor numbers. However, this number had remained relatively stable since 2022 – until now.

Around the time of the offering, Nasdaq CSD processed approximately 70,000 instructions for the transfer of Íslandsbanki shares, ultimately delivering shares to 31,000 participants. The settlement of this historic offering went remarkably smoothly, thanks to thorough preparation and close collaboration with financial institutions involved in the process. Receiving payments and ensuring timely delivery of shares to 31,000 individuals is a major and critically important task.

It is important for any stock market that retail investor participation is strong and active, benefiting both companies seeking capital and investors – large and small alike. Clearly many individuals engaged in stock trading for the first time during the Íslandsbanki offering. It would be a positive outcome if this experience encouraged them to further explore the stock market and consider long-term participation.

*The total number of individuals holding shares in companies listed on Nasdaq Iceland and the Nasdaq First North Growth Market. These figures reflect all listed companies, not just Íslandsbanki, as some companies gained new shareholders during this period.