It seems like you are visiting us from out of our market place.

You can continue our General landing page for overview of Nasdaq CSD activities.

Or select market/ location below:

It seems like you are visiting us from out of our market place.

You can continue our General landing page for overview of Nasdaq CSD activities.

Or select market/ location below:

Published on 06.03.24

Corporate action processing at Nasdaq CSD: Transparent, Accurate and Efficient

Central securities depositories (CSDs) play a pivotal role in streamlining and standardizing the handling of corporate actions, such as dividends, interest payments, mergers, and stock splits. This centralized approach enhances transparency, reduces operational risks, and ensures timely and accurate dissemination of information to market participants and investors. By providing a standardized platform for corporate action processing, CSDs contribute to the overall integrity and stability of the European financial infrastructure, fostering investor confidence and facilitating smooth market operations.

Nasdaq CSD has for over six years served as a central hub for the Baltic and Icelandic securities markets and streamlined the complexity of different corporate actions. Adherence to international corporate action standards, a modern e-Services system for issuers and the core CSD system for participants enhance operational efficiency as well as reduce the risk of errors and discrepancies in the processing of various corporate events in the respective markets.

Need for standardized corporate events processing

In Europe, the compliance monitoring exercise organized by the Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo) assesses compliance with corporate event standards, specifically the “Market Standards for Corporate Actions Processing” (Market CA Standards), “TARGET2-Securities Corporate Actions Standards” (T2S CA Standards), and the “Market Standards for Shareholder Identification” (SI Standards). Full participation by all AMI-SeCo markets in the 2023 monitoring exercise revealed varying compliance levels across Europe, with some markets showing significant progress in adopting the Market CA Standards and T2S CA Standards, while few faced decreases in compliance. Among other aspects, challenges included inconsistencies in the definition of “a shareholder” across markets and difficulties in cross-border activities, highlighting the need for a harmonized European definition of “a shareholder”.

Baltics and Iceland among leading markets in adhering to corporate events protocols

Nasdaq CSD in Baltics is fully compliant with all three sets of above-mentioned AMI-SeCo standards, indicating robust adherence to corporate event protocols. This compliance level places Nasdaq CSD among the leaders in Europe in terms of aligning with established standards for corporate actions, T2S, and shareholder identification. Nasdaq CSD has effectively implemented the required measures for corporate action processing and shareholder identification, ensuring efficient and transparent operations within the markets it serves.

Nasdaq CSD in Iceland, as a part of its second year participating in the AMI-SeCo corporate events compliance monitoring exercise, reports a compliance level similar to that of Estonia, Lithuania, and Latvia. Even though Nasdaq CSD in Iceland is not part of T2S, the compliance with T2S CA Standards and the Market CA Standards has proven to be very beneficial for the Icelandic market. It has transformed the corporate action environment in the Icelandic market by providing a safe and robust means of information flow from issuers to investors, using standards and internationally recognized methods. There is still a compliance gap in Iceland relating to the standards referring to the flow of information from CSD participants to end investors, but methods to improve that will be addressed in a local CA market practice group that will be launched this year. Additionally, as the SRD II is expected to be transposed into Iceland’s national legislation in 2024, the SI Standards were not applicable for the current reporting cycle.

Corporate events processing at Nasdaq CSD in 2023

Nasdaq CSD processed 5 428 CA events in 2023, that is 12.2% more than in 2022. Total value of CA events processed by Nasdaq CSD during 2023 constituted 16.8 BEUR. The most requested type of CA event during 2023 was interest payment for the debt securities, that made 43% of total number of events processed at Nasdaq CSD.

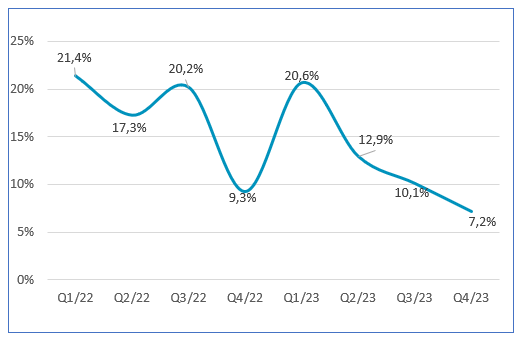

Graph 1. Corporate Actions Growth, Volume (YoY, %)

An average growth of 15% has been observed over last 8 quarters.

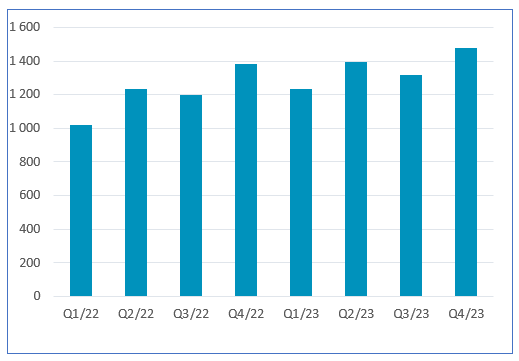

Graph 2. Number of Processed Corporate Actions.

Figures in Q2 and Q4 typically demonstrate higher numbers as a result of seasonal factors.

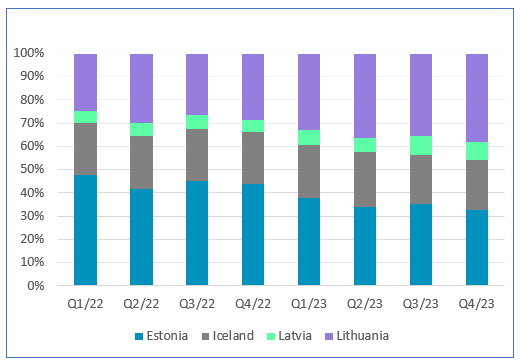

Graph 3. Corporate Actions Share by Country, Volume.

Estonia and Lithuania represent the highest number of CA, accounting for over 70% of the total CA volumes.